Roth Ira Calculator Moneychimp

The advantage of a roth ira over a traditional deductible ira is almost obvious.

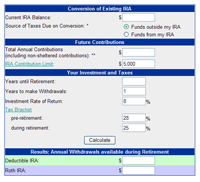

Roth ira calculator moneychimp. On withdrawal you report the entire withdrawal amount as taxable. This is a fixed rate calculator that calculates the balances of roth ira savings and compares them with regular taxable savings. Answer a few questions in the ira contribution calculator to find out whether a roth or traditional ira might be right for you based on how much you re eligible to contribute and how much. For calculations or more information concerning other types of iras please visit our ira calculator.

A roth ira is intended to be a retirement account so penalties apply if you misuse it by withdrawing funds too early. A 401 k is an employer sponsored retirement plan that lets you defer taxes until you re retired. In addition many employers will match a portion of your contributions so participation in your employer s 401 k is like giving yourself a raise and a tax break at the same time. The roth ira provides truly tax free growth.

Traditional ira calculator can help you decide. Call 866 855 5636 or open a schwab ira today. Use an inflation adjusted return rate to put the other numbers approximately into today s dollars. The roth ira can provide truly tax free growth.

It requires no special reporting to the irs. Ideally you should contribute up to the limit while you re working in order to maximize your tax savings. This calculator lets you see how a roth ira will fit into your own plans. As a rule you should plan not to make any withdrawals until at least age 59 or five years after you make your first contribution whichever comes later.

Source of taxes due on conversion. Fidelity s ira tools and calculators will help you better understand how to invest with an individual retirement account ira. There is no tax deduction for contributions made to a roth ira however all future earnings are sheltered from taxes. Creating a roth ira can make a big difference in retirement savings.

Use our roth ira calculator to determine how much can be saved for retirement. If you select funds outside your ira an amount equal to the tax due is added to the non sheltered account corresponding to the deductible ira. Choosing between a roth vs. Investing with an ira.

Traditional ira depends on your income level and financial goals. It is mainly intended for use by u s. With a deductible ira you have to report a deduction on your 1040 form when you make a contribution. There is no tax deduction for contributions made to a roth ira however all future earnings are sheltered from taxes under current tax laws.